infrastructure investment and jobs act tax provisions

The Senate passed the bill in August 2021 also with bipartisan support. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Biden S Infrastructure Bill Will Bring Jobs Build Back Better Is Aimed At Reducing Inequities The Washington Post

2 The Bill was initially passed by the Senate in August.

. The Infrastructure Investment and Jobs Act Includes Tax-Related Provisions You Will Want To Know About Publication 111721 By. This article has been updated from an earlier version. Raise the tax on Global Intangible Low Tax Income GILTI to 21 percent calculate it on a country-by-country basis and eliminate the exemption of.

Tax-related Provisions of the Infrastructure Investment and Jobs Act Almost three months after it passed the US. 3684 by a vote of 228-206 with the support of 13 Republicans. The bipartisan Infrastructure Investment and Jobs Act will invest 110 billion of new funds for roads bridges and major projects and reauthorize the surface transportation program for the next.

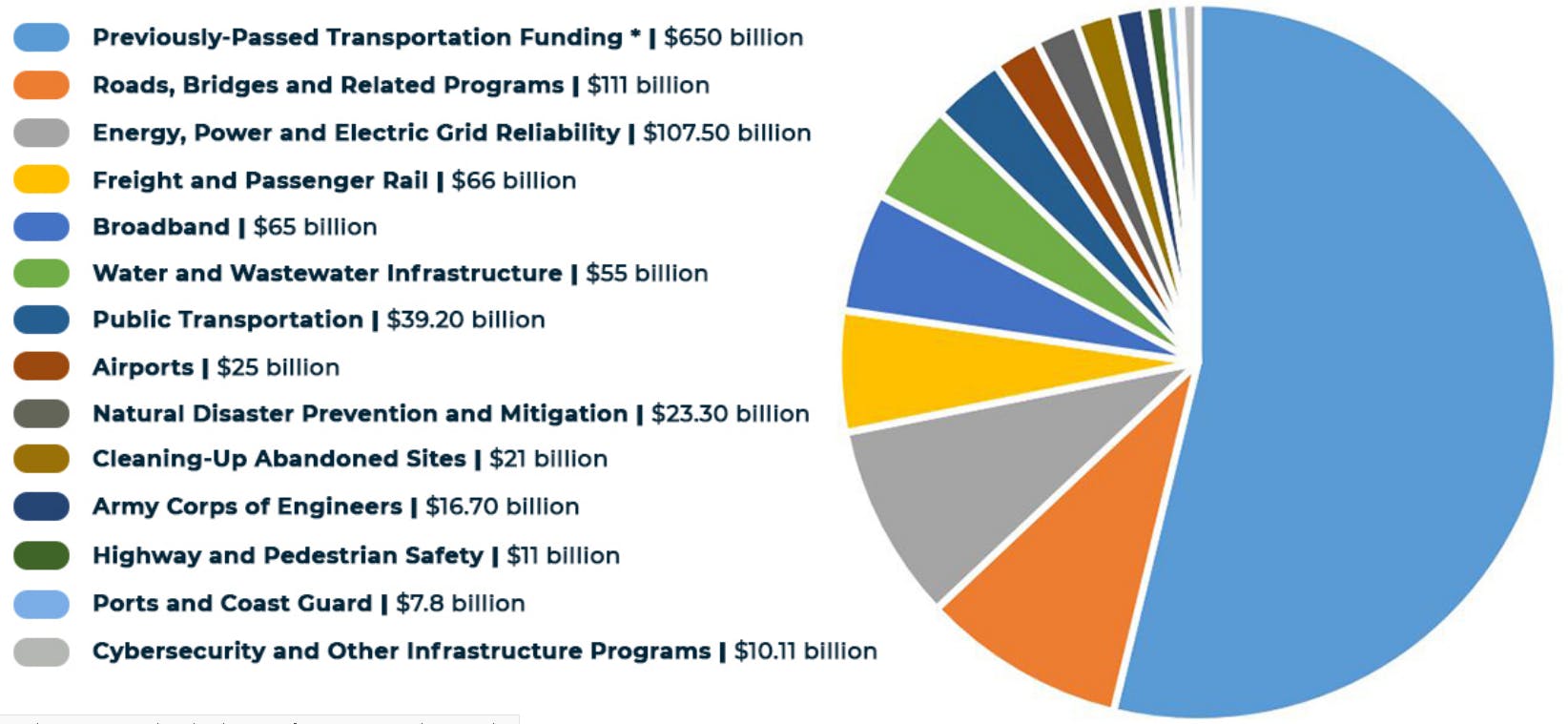

1 The Bill includes 550 billion in new spending on infrastructure over the next five years. The vote was 228 to 206. Active transportation infrastructure investment program.

Almost three months after it passed the US. Transportation Infrastructure Finance and Innovation Act of 1998 amendments. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked.

Thus congressional action of this bill has been. Robert Swenson Almost three months after it passed the US. Roads bridges and major projects.

On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. Highway cost allocation study.

Tax-Related Provisions in the Infrastructure Investment and Jobs Act By. Infrastructure Investment and Jobs Act. Tax-related provisions in the Infrastructure Investment and Jobs Act November 15 2021 Almost three months after it passed the US.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. Senate passed the same version of the bill on August 10 2021 on a bipartisan basis. Passenger and freight rail.

3684 the Infrastructure Investment and Jobs Act. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. Power and grid reliability and resiliency.

Sunday 23 January 2022. Here is what you need to know. Increase the federal corporate tax rate from 21 percent to 28 percent and tighten inversion regulations.

While the bulk of the law is directed toward massive investments in infrastructure projects across the country a handful of noteworthy tax provisions are tucked inside it. Tax Provisions in the Infrastructure Investment and Jobs Act. EARLY TERMINATION OF THE EMPLOYEE RETENTION CREDIT.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. The American Jobs Plan Biden infrastructure plan would raise taxes on corporations in several ways. P resident Joe Biden signed the 12 trillion Infrastructure Investment and Jobs Act.

Among other provisions this bill provides new funding for infrastructure projects including for. Today Congress passed the Bipartisan Infrastructure Deal Infrastructure Investment and Jobs Act a once-in-a-generation investment in our nations infrastructure and competitiveness. One way the Democrats got Republican buy-in is that early on they substituted tax.

The Infrastructure Investment and Jobs Act includes tax provisions youll want to know about Almost three months after it passed the US. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. The legislation includes tax-related provisions.

Todd Schanel CFA CPA CFP on November 11 2021 Almost three months after it passed the US. Employee Retention Credit Changes. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. On November 5 2021 Congress passed a 12 trillion bipartisan infrastructure bill known as the Infrastructure Investment and Jobs Act the Bill. Highway and pedestrian safety.

House of Representatives tonight passed HR. Breaking Down the Infrastructure Investment and Jobs Act. President Biden signed the bill into law on November 15.

Federal requirements for TIFIA eligibility and project selection.

Livfin Raises Equity From German Major Deg For Further Expansion Makerspace Investment In India Energy Storage

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Infrastructure Investment And Jobs Act Iija Implementation Resources

What S In The Broadband Component Of The Infrastructure Bill

Everything In The 1 2 Trillion Infrastructure Bill New Roads Electric School Buses And More

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Myths And Facts Infrastructure Investment Jobs Act

Infrastructure Investment And Jobs Act Iija Implementation Resources

Infrastructure Investment And Jobs Act Iija Implementation Resources

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

What Is In The Bipartisan Infrastructure Legislation Npr

New Infrastructure Law To Provide Billions To Energy Technology Projects American Institute Of Physics

Biden Signs Infrastructure Law Here S How It Will Streamline 1 Trillion In Spending

What Is In The Bipartisan Infrastructure Legislation Npr

Biden Signs 1 Trillion Bipartisan Infrastructure Bill Into Law

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Infrastructure Bill Includes Tax Provisions To Know About

The Infrastructure Plan What S In And What S Out The New York Times