new mexico solar tax credit 2020 form

Waterproof IP65 and Heatproof outdoor security night light for wall patio garden porch lawn pathway gutter etc. 2021 Sustainable Building Tax Credit Corporate NM.

Ev Discounts Rebates Pnmprod Pnm Com

The Schumer-Manchin bill provides that after 2024 the traditional PTC and ITC programs expire but the benefits live on through the new Clean Electricity tax credit program Based on published project footprints of recently sited wind projects in Wyoming Oklahoma New Mexico and Colorado new wind turbines will spread across 30.

. Starting January 1 2022 your maximum tax savings will be 30 of whatever the panels cost your business or real estate activity. When the amount spent on the solar PV system is predominantly used for residential rather than business purposes the residential credit may be claimed in full without. 2020 - History repeated.

More on the Investment Tax Credit. And one of the largest crew bases in the country plus a very generous refundable tax credit. Plan your Solar Panel Business.

Nevertheless the 30 ITC still applies and it allows you to deduct a huge portion of your investment as soon as you file your next tax declaration. For full details on each new feature click here. Federal Solar Tax Credit ITC The federal solar investment tax credit or ITC allows homeowners to claim 30 of their system costs as a credit against the federal taxes they owe.

Register your Solar Panel Business for Taxes. High Efficient Solar Panel Our solar Panel is energy saving and with PET laminated solar panel and LED lights which is up to 20. During a meeting with the New York Times Editorial Board in January 2016 Trump said he.

Weve been hard at work making Intuit ProSeries Tax even easier to use so you can save time on every return. The investment tax credit ITC also known as the federal solar tax credit allows you to deduct 30 of the cost of installing a solar energy system from your federal taxes. - An extra 500 in tax credit on top of the 30 federal tax credit when you purchase a PV system in Kentucky.

- If youre a customer of the Tennessee Valley Authority utility TVA you get a 1000 rebate for going solar and a feed-in tariff equivalent to the retail electricity price plus 002kWh which is even better than net metering. The solar investment tax credit ITC or federal solar tax credit has been one of the most successful incentives in spurring the growth of solar energy in the US. New systems need to be activated before 1123 to claim a tax credit on your 2022 federal taxes so request a.

Trump adopted his current views on trade issues in the 1980s saying Japan and other nations were taking advantage of the United States. Including a 50-megawatt facility slated to be the third-largest solar project on tribal land in the nation. Get the Necessary Permits Licenses for your Solar Panel Business.

Set up Accounting for your Solar Panel Business. - it was a hard decision but I believe it is the right move That being said we took advantage of the current 2020 26 tax credit and it goes down to 22 in 2021 and in 2022 there is no tax credit. To claim the federal solar tax credit complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR.

Start a solar panel business by following these 10 steps. However the benefit expired in December 2015. Start Grow or Relocate your business to New Mexico with the New Mexico Economic Development Department.

The Residential Clean Energy Credit can be filed one time for the tax year in which you install your system using Tax Form 5695. 2021 Sustainable Building Tax Credit Personal NM. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

The credit is set to reduce to 26 in 2033 and 22 in 2034 and will be eliminated for residential systems in 2035 unless it is extended by the federal government. The former New Jersey Clean Energy Program rebates on PV equipment have been discontinued. Yes but if the residence where you install a solar PV system serves multiple purposes eg you have a home office or your business is located in the same building claiming the tax credit can be more complicated.

New Solar Market Development Tax Credit. 2W Monocrystalline silicon. Form your Solar Panel Business into a Legal Entity.

- solar systems are warranted for 25 years and after 20 years our loan will be paid off. 5 Conversion Rate with 1. The federal Residential Energy Efficient Property Credit income tax credit on IRS Form 5695 for residential PV and solar thermal was extended in December 2015 to remain at 30 of system cost parts and installation for systems put into service by the end of 2019.

The ITC applies to both residential and commercial systems and there is no cap on its value. They guarantee 80 panel efficiency at 25 years. Read the 2021 instructions for Form 5695 PDF.

Open a Business Bank Account. Thats because new home solar and battery storage customers are now eligible to claim up to 30 of their systems cost as a credit on their federal taxes. Through 2022 the solar tax credit is good for 26 of the system costs.

North Carolina Tax Credit. An extra 35 on top of the 30 federal tax credit. What expenses are.

Aimed to offset the initial cost of solar it allows you to deduct 30 of the total cost of your solar project from the federal taxes you owe. In 2023 the credit goes down to 22 and you likely wont be able to claim the federal solar tax credit at all in 2024. During the 2016 presidential campaign Trump repeatedly favored policy proposals that renegotiate trade agreements for the United States.

Read More About Film Television. Returning ProSeries Professional and ProSeries Basic customers. Tax Credits Rebates Savings Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates.

The ITC steps down to 26 in 2020. As the states largest electricity provider PNM serves more than 530K New Mexico residential and business customers in Greater Albuquerque Rio Rancho Los Lunas Belen Santa Fe Las Vegas Alamogordo Ruidoso Silver City Deming Bayard Lordsburg and Clayton. Go to the Help menu in your tax year 2020 software and select Download.

The credit received is then calculated dollar-by-dollar as a reduction of your federal tax liability so if you receive 1000 in credits youll owe 1000 less in taxes. Section 13102 of the Inflation Reduction Act extends the commercial tax credit for solar panels in Section 48 of the IRC to 2034 with a phase-out beginning in 2032. North Carolina used to have one of the best tax credits in the nation.

Whats new in ProSeries Tax 2021.

Current Challenges To Tax Equity Part Three Clean Energy Finance Forum

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Solar Plus Storage Replaces Coal Plant In New Mexico Makes Carbon Capture Retrofit Moot Pv Magazine Usa

Business Activity Code For Taxes Fundsnet

Wells Fargo Provides Tax Equity Financing For Solar Storage Project Pv Magazine Usa

Strong Growth Ahead For Battery Storage Pv Magazine International

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar

Ion Solar Faqs Frequently Asked Solar And Company Questions

New Mexico Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Full Guide To Residential Solar Panels In Texas Updated For 2021

Current Challenges To Tax Equity Part Three Clean Energy Finance Forum

Federal Solar Tax Credit Guide Atlantic Key Energy

Business Activity Code For Taxes Fundsnet

Federal Solar Tax Credit Guide Atlantic Key Energy

Business Activity Code For Taxes Fundsnet

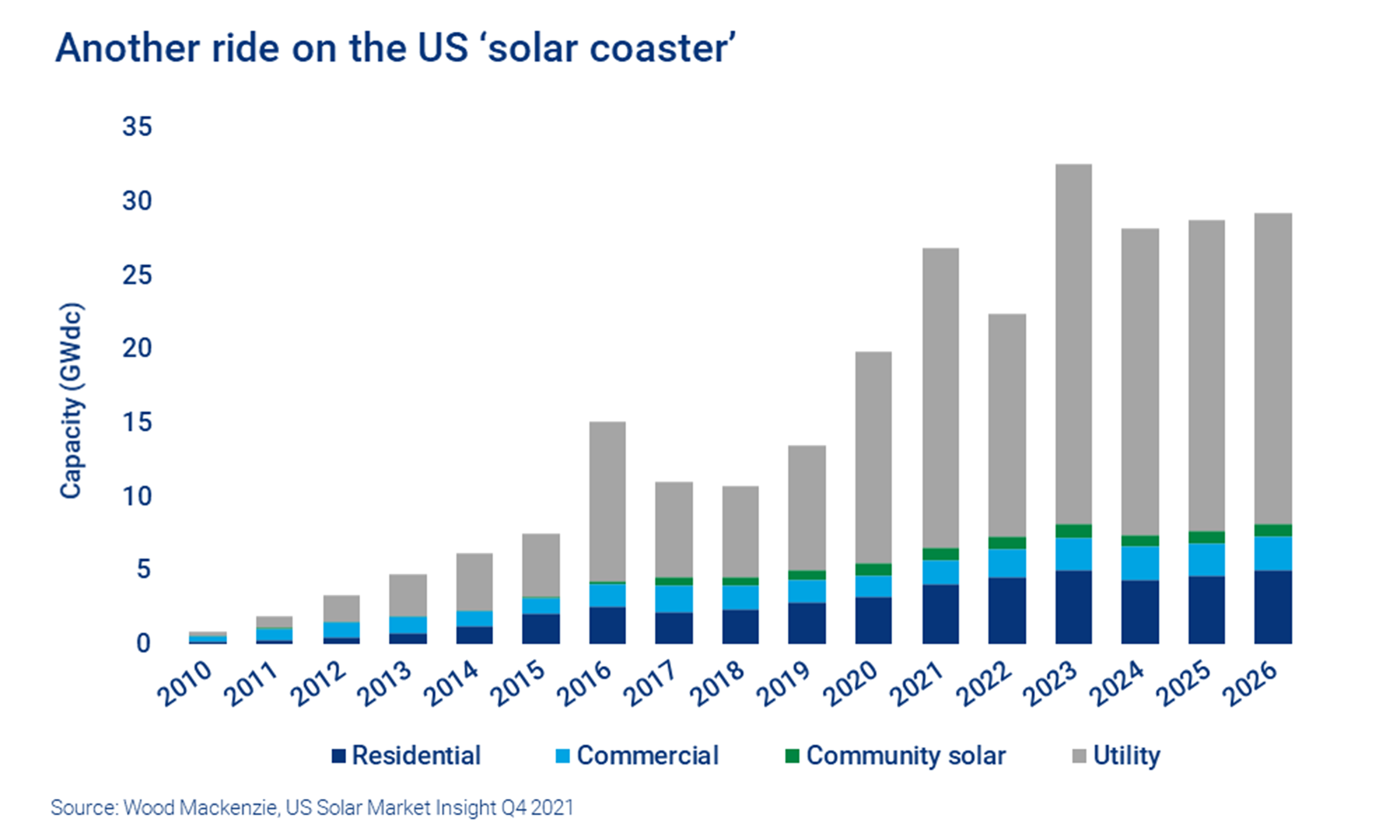

Redefining The Us Solar Coaster Wood Mackenzie

Incentives Drive Solar Adoption Among Low To Middle Income Residents Pv Magazine Usa