federal tax abatement meaning

Real property must be reported on Form 1040-NR US. 1903 provided that as soon as practicable after Dec.

New Texas Tax Law A Boon For Renewable Energy Development Solar Industry

An amount of money paid to the government that is based on your income or the cost of goods or.

. Join the discussion about your favorite team. It also discusses reasonable cause criteria per IRC 6724 and 26 CFR 3016724-1. For federal tax purposes for all taxable years prior to the discovery year including.

A Regulatory Floodway comprises the channel of a river or other watercourse and the adjacent land areas that must be reserved in order to discharge the base flood without cumulatively increasing the water surface elevation more than a designated height. 12101 et seq and. Restrictions may be ordered only pursuant to a law.

1 2022 must be reported in the database within 14 days of. Read about the changes and find links to the new Department of Climate Change Energy the Environment and Water. Roughly 45 of US.

Religious freedom shall not justify practices inconsistent with public morals peace or safety. All active agreements meaning agreements that were in effect as of Jan. A federal tax lien exists after.

The lien protects the governments interest in all your property including real estate personal property and financial assets. 17 1999 113 Stat. 12-126 re abatement or refund of tax on tangible personal property assessed in more than one municipality.

No revenue of the state or any political subdivision or agency thereof shall ever be taken from the public treasury directly or indirectly. Puts your balance due on the books assesses your. Tax applies to the sale of manufacturing aids such as dies patterns jigs and tooling used in the manufacturing process notwithstanding the fact that the property used in manufacturing may subsequently be delivered to or held as property of the.

Ultimately the Missions. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic. Sections 6007-60091 and 60105 Revenue and Taxation Code.

Noun a charge usually of money imposed by authority on persons or property for public purposes. This is the segment of the floodplain that will generally carry flow of flood waters during a flood and is typically the area of. This IRM provides policy and procedures for the application of information return penalties assessable under IRC 6721 IRC 6722 and IRC 6723.

Also Part I 165. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally. This payment is required in addition to the application fee.

The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late. The Business Support Office BSO is. Determination of correct tax liability.

Tax rates for individuals estates and trusts for taxable years after 1994. 1 2022 were required to be reported by May 1 2022. The Department of Industry Science Energy and Resources is now the Department of Industry Science and Resources.

The gain or loss on the sale of your US. B A tax abatement agreement made by a county has the same effect on the school districts and other taxing units in which the property subject to the agreement is located as is provided by Sections 312206a and b for an agreement made by a municipality to abate taxes on property located in the taxing jurisdiction of the municipality. All operating division employees who address information return penalties.

If for example you receive a coronavirus-related distribution in 2020 you choose to include the distribution amount in income over a 3-year period 2020 2021 and 2022 and you choose to repay the full amount to an eligible retirement plan in 2022 you may file amended federal income tax returns for 2020 and 2021 to claim a refund of the. 106170 title III 303a Dec. Federal income tax withheld that is listed on your Form 8288-A must be entered in the Payments section on page 2 of Form 1040-NR for you to receive credit for the tax withheld.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. There shall be no law respecting the establishment of religion or prohibiting or penalizing the free exercise thereof. Nonresident Alien Income Tax Return.

The 20 percent payment is generally nonrefundable meaning it wont be returned to the taxpayer even if the offer is rejected or returned to the taxpayer without acceptance. A Subject to the provisions of subsection B for taxable years beginning after 1994 a tax is imposed on the South Carolina taxable income of individuals estates and trusts and any other entity except those taxed or exempted from taxation under Sections 12-6-530 through 12-6-550. Big Blue Interactives Corner Forum is one of the premiere New York Giants fan-run message boards.

Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent. Any agreements entered into amended or renewed after Jan. A sum levied on members of an organization to defray expenses.

If the restriction serves to protect the free democratic basic order or the existence or security of the Federation or of a Land the law may provide that the person affected shall not be informed of the restriction and that recourse to the courts shall be replaced by a review of the case by agencies and auxiliary agencies appointed. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. IRM 2174410 Federal Income Tax Withheld FITWBackup Withholding BUWH on Income Tax Returns IRM 214514 Interest and Penalty Consideration for Category D Erroneous Refunds IRM 2179416 Duplicate Filing Conditions Involving.

Title to which passed to federal government under provisions of contract of manufacturer may not be taxed to plaintiff who had nothing except right to its use and possession. An individual for whose benefit a health savings account within the meaning of section 223d is established shall be exempt from the tax imposed by this section with respect to any transaction concerning such account which would otherwise be taxable under this section if with respect to such transaction the account ceases to be a health savings account by reason of the. Important IRS penalty relief update from August 26 2022.

17 1999 the Comptroller General was to undertake a study to assess existing tax credits and other disability-related employment incentives under the Americans with Disabilities Act of 1990 42 USC. Households or 59 million didnt have a checking or savings account with a bank or credit union in 2021 a record low according to the Federal Deposit Insurance. Instead the 20 percent payment will be applied to the taxpayers tax liability.

This is effected under Palestinian ownership and in accordance with the best European and international standards. The amount of US. Meaning of 165e is the discovery year described in section 404 of this revenue procedure.

Tax Penalty Abatement Waiver Of Tax Penalties Help In California

Doing Business In The United States Federal Tax Issues Pwc

20 1 9 International Penalties Internal Revenue Service

Tax Collections Liens Levies Penalty Abatement Lawyer Maryland And Florida

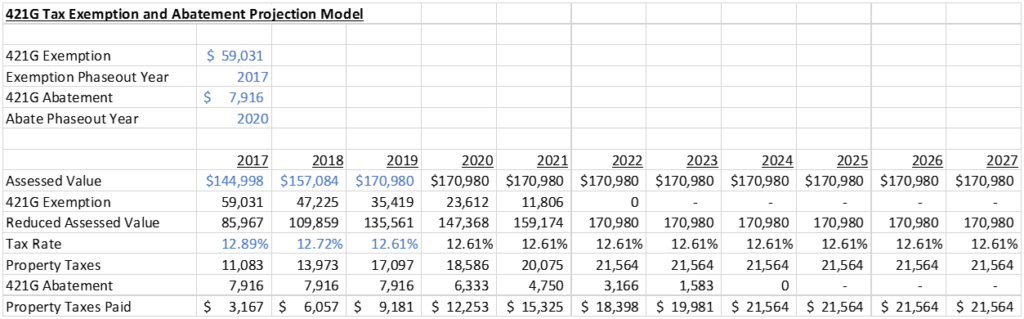

What Is The 421g Tax Abatement In Nyc Hauseit

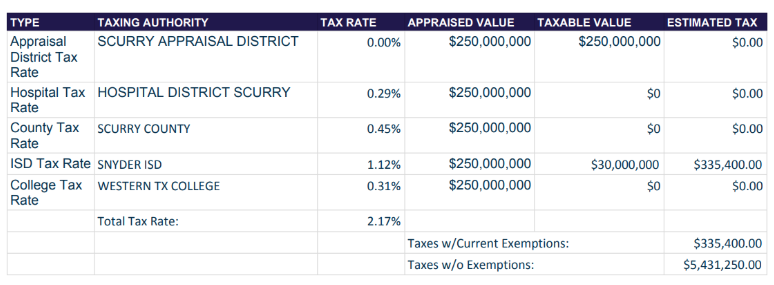

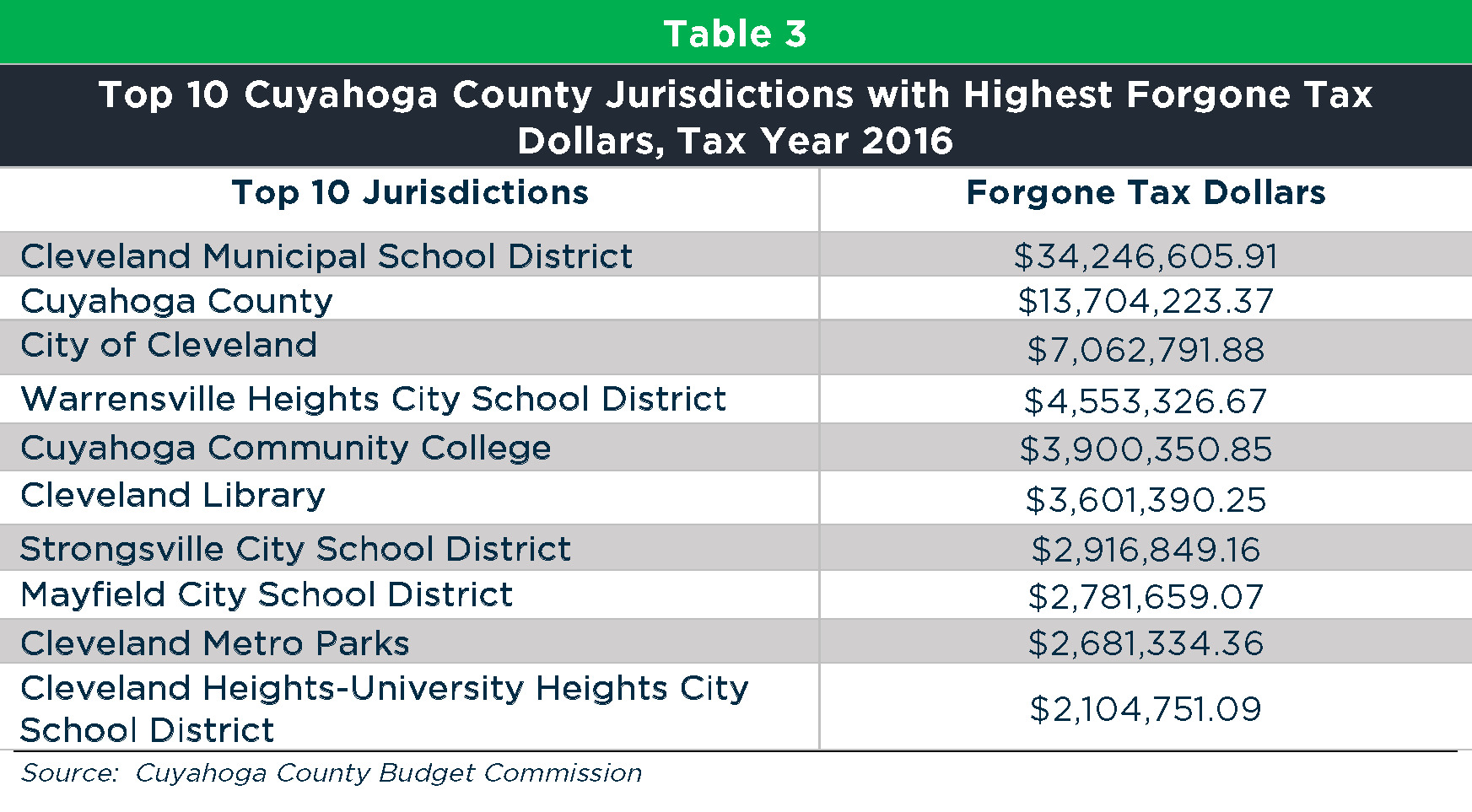

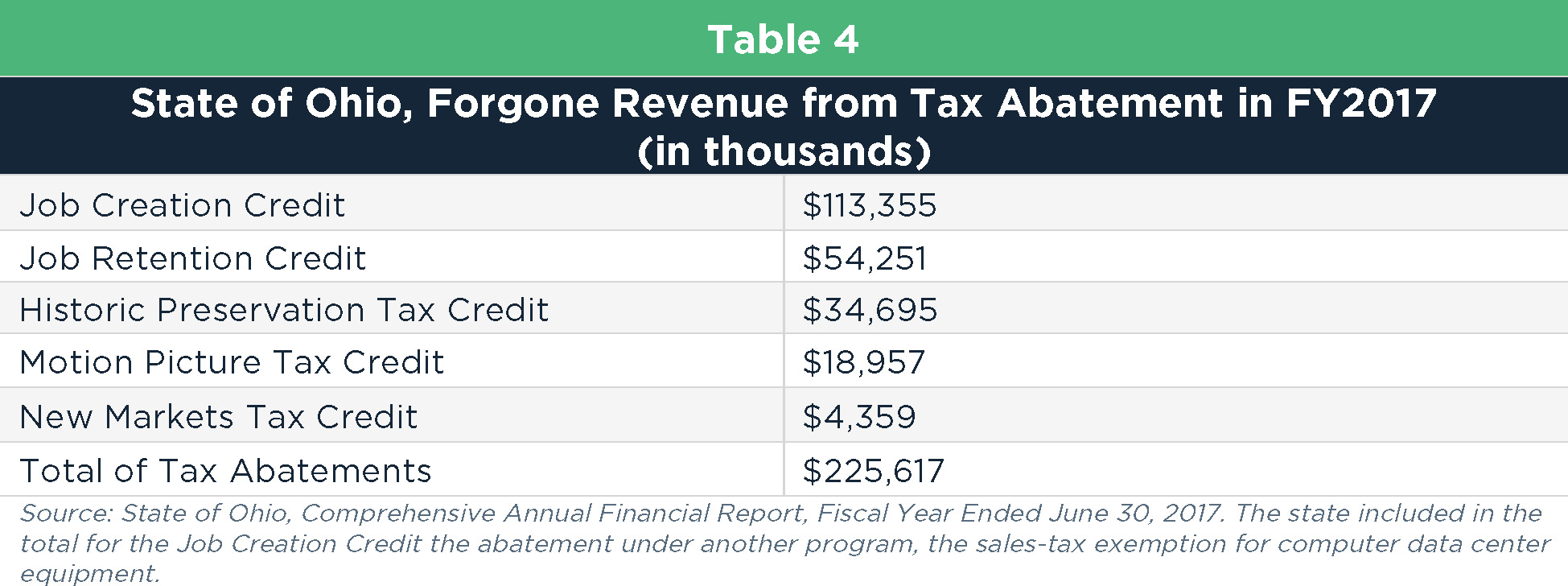

Local Tax Abatement In Ohio A Flash Of Transparency

How To Deal With Penalties From Tax Non Payment Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Local Tax Abatement In Ohio A Flash Of Transparency

What Is Tax Resolution Solving Irs Tax Problems

Local Tax Abatement In Ohio A Flash Of Transparency

Am I Eligible For Tax Abatement

5 17 2 Federal Tax Liens Internal Revenue Service

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

:max_bytes(150000):strip_icc()/GettyImages-1351333930-c16be1d0252a4a798f08cfb753f744fb.jpg)

Taking Advantage Of Property Tax Abatement Programs

Property Tax Abatements How Do They Work